PV panels: more power for less cash in 2017

Efficiency up, price down: 2017 promises to be a good year for PV panels. A commentary on the current and future module-market by Martin Schachinger, pvXchange.

After another sharp drop in November, prices for PV panels have generally stabilized in the first few days of December. Dealers seem to have woken up to the fact that even prices under EUR 0.35 a watt are not enough of an incentive to make a purchase in the last few weeks of the year. PV plants that had to be built in 2016 have already been thoroughly planned and the materials purchased. And buying modules for projects coming up next year is not on many installers minds. Although conditions and prices are being monitored carefully, hardly anybody wants to commit in a market with such volatile prices. It is still unclear whether prices will continue to fall further, especially for panels in the higher performance classes. We have seen astonishing development in that segment over the past few months.

Efficiency up, price down for PV panels

Availability of newly produced PV panels in the mid-range performance classes is drying up. Although 255, 260 and 265 watts-peak for modules with 60 monocrystalline cells was the general standard until recently, there is now a strong trend in the direction of 270 to 280 watts. Up to now, however, this kind of performance could only be achieved by modules with monocrystalline cells which, justified or not, were then sold at a markup. Through the widespread use of PERC and PERT technologies in European and Asian module manufacturing, high capacities can now be achieved with polycrystalline, resulting in much cheaper cells.

Does it make sense in today’s market to sign supply agreements before year’s end or even lay up goods in a warehouse that will not be installed until springtime, or would it be better to wait and see? Forecasting price developments for the near future is not an easy call right now. Some manufacturers are convinced that the market has found the bottom, and that module prices will rise slightly at the beginning of the new year. They are basing their claim on rising demand, particularly in Asia, in the face of supply bottlenecks. However, current unutilized capacities in China may be so vast that they can easily cover any uptick in demand, either domestically or in any market not saddled by restrictions. That would argue against any noticeable price rise.

Wait or act: Installers have to decide

People who want to equip their PV systems with highly efficient modules can afford to wait and speculate on ever-expanding product diversity and falling prices. The only ones who need to hurry are designers and installers whose projects have been collecting dust in a desk drawer in the hope of better times – for instance, the numerous yet-to-be-built systems from German ground-mounted plant tenders. Many of these systems were designed to use modules at the lower end of the efficiency spectrum. But the availability of such products, as already mentioned, is starting to wane, which does not exactly bode well for price development.

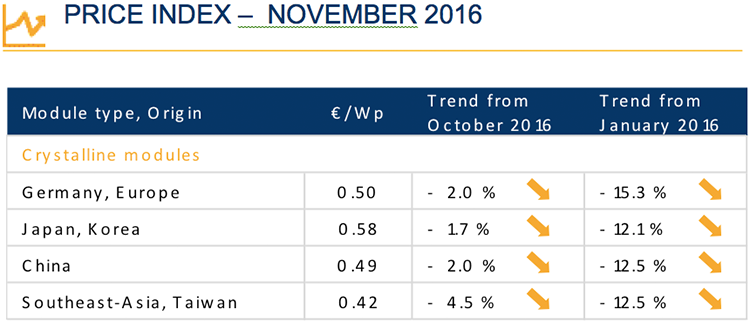

Overview by technology of different price points in November 2016, including the changes over the previous month:

Source: Martin Schachinger, pvXchange.