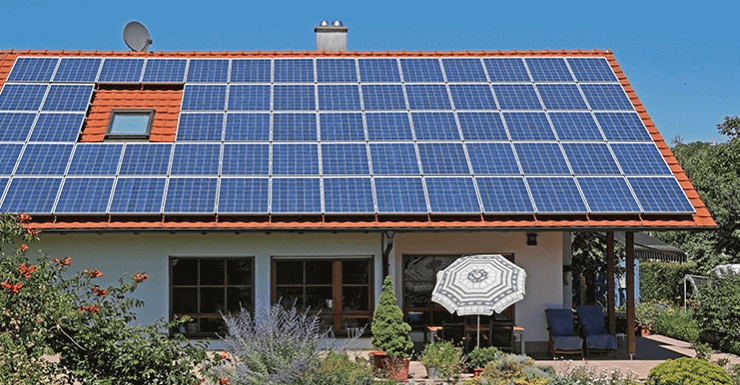

5 Reasons To Sell Your Photovoltaic System In 2021

There are many reasons behind a sale, but a lot of questions when doing so arise. Where do you find the right buyers, how do you determine the right price and how do you handle the sale properly? You will learn in this article what is important to do when selling.

A commercial photovoltaic system is a long-term, well-invested asset with a balanced risk-return profile. Moreover, not only your wallet benefits, but also the climate. Nevertheless, there may be good reasons for selling a photovoltaic system.

Reasons to sell a solar power plant

1. Short-term need for liquidity due to economic necessity

Economic conditions can change unexpectedly during the long life of a photovoltaic system and unplanned situations can arise in your professional environment that force you to quickly “liquidate” your tied-up capital that is not required for operations. In many cases, it is better to part with your photovoltaic system than to go further into debt.

2. Short-term liquidity needs due to personal necessity

Personal circumstances can also change unexpectedly, leading to the need for liquidity quickly. This is particularly true in the case of divorce and inheritance disputes. Since solar plants often offer little leeway for further debt, the only option is often to sell the plant in order to raise the necessary liquidity for, for example, equalisation of gains or inheritance taxes.

3. Make profits

Since the demand for investment objects with a comparable risk-return profile considerably exceeds the supply, the sale of a photovoltaic system can be lucrative. The liquidity freed up by the sale is often used to invest in new photovoltaic systems by taking advantage of existing special tax effects. It is important to consult an experienced tax advisor, as the devil always lies in the detail.

4. Save time and nerves

Over the 20-year lifespan, operating a photovoltaic system can become a burden under certain circumstances. Especially if your plant is not in the vicinity, it has technical problems, the administrative effort is greater than expected after all, or the relationship with the roof or land lessor has broken down, you can free yourself from this by selling it.

5. Portfolio restructuring

It may also be the case that a PV system portfolio that has been bought together wildly over the years needs to be structured to be able to manage it more effectively. Individual solar plants may be too far away, too large or too small, or may be located as outliers on a roof or open space. Selling in a targeted manner and then reinvesting in a structured manner brings more consistency to the portfolio.

Regardless of why you should decide to sell, you need to find a suitable buyer. In this case, your tax advisor is often the first port of call to discuss tax implications at the same time. The plant builder and acquaintances from your own circle of family and friends are also often approached, which can be a difficult constellation during sales and contract negotiations.

But you can also hire brokers, they should however have experience in selling solar power plants and be satisfied with a moderate brokerage fee. Check the brokerage contract in advance to see whether it contains the marketing exclusivity that is often demanded. This can prevent or complicate the sale. Alternatively, you can rely on specialised online photovoltaic marketplaces such as Milk the Sun.

Three steps to the sale

On our online sales platform, the sale is handled according to the following transferable scheme:

Determine fair market value

To sell your PV system, you need to determine the fair market value. This is calculated by discounting expected future income and costs from the date of sale until the end of the remuneration at a market comparable interest rate.

You can carry out this calculation on Milk the Sun with a free sales value calculator.

Naturally, you want to achieve the highest possible price for your offer. But the buyer’s goals are also relevant to the price: potential buyers want to earn interest on their investment amount.

If the system price is calculated in such a way that the buyer can achieve a return in line with the market and you earn good money on the sale, there is a win-win situation desirable for both sides.

Finding a suitable investor

In the large network of our platform, there is considerable competitive pressure among the numerous investors, such as private and commercial investors, family offices, companies, funds or asset management companies.

Prepare the sales process properly

The be-all and end-all for a successful sales process is preparation. The first thing to check is whether you are entitled to sell at all. You are only entitled to sell if a first-ranking right of use to the roof or open space for the operation of a PV system is registered in the land register.

In addition, the financing bank often has a say in the matter, since the PV system has been assigned as collateral and the feed-in revenues have been transferred to it. If this is the case, you need: complete plant documentation, properly collected documents and contracts, as well as meaningful pictures of your plant.

Throughout the entire sales process, Milk the Sun is there for you and provides you with competent advisors to clear up any questions and ambiguities you might have.

This is a free translation. To read the original article in German: click here.