Research considers U.S. utility-scale solar market jeopardized due to risky behaviour of developers

The U.S. utility-scale solar market is based largely on power purchase agreements. However, recently developers have taken a rather risky approach which endangers the whole industry.

Two power-purchase agreements (PPAs), arranged for a period of 20 and 25 years, made the U.S. solar market grow initially. However, these long-term agreements are seemingly a thing of the past, as recent agreements were only made for periods of 10 – 15 years. As a result, Bloomberg New Energy Finance (BNEF) considers the U.S. solar market jeopardized, as this approach might increase debts and raise prices.

BNEF considers approach risky

Their report states that „in order to make the numbers work on a PV project with a 10-year power, $40 per megawatt-hour PPA (…) a developer must assume that prices for the power it will sell after the PPA expires rise faster than inflation, that it must take out back-levered debt, or both.“ Based upon the belief that cheap debt will contunue to be available and that the prices for PV will increase in the future, many developers have chosen to consent to these possibly fatal agreements.

Two main factors provoke recent development in U.S. utility-scale solar market

According to BNEF, the solar power contract prices in the U.S. have fallen by a total of 17% since 2006. At the same time, there is an increase of contracts at avoided cost rates, based on the strong competition between developers. Moreover, low wholesale power prices are lowering the prices even further

PURPA has key role in development

This recent development researched and described by BNEF is strongly influenced by PURPA, the Public Utilities Regulatory Policy Act (PURPA) from 1978. This law ensures that providers purchase power from independent producers whenever these can meet the cost the providers would otherwise pay for energy. Over the past few years PURPA has helped push utility-scale solar power in the U.S..

PURPA is implemented state-by-state, which results in contracts of different lengths, sometimes only 10 – 15 years, with no guarantee for a renewal. “Changes in states’ implementation of PURPA are being considered today,” BNEF Senior Analyst Nathan Serota told pv magazine. “For developers with large footprints in places like Montana and North Carolina, this is far and away their primary PURPA-related concern.”

Prices set to fall

However, no matter if there is a contract extension or not: developers depend on the expected power prices and are thus looking for the best, high-priced forecast. But prices are hard to predict and BNEF criticizes that most wholesale power prices are based on rates from the early 2000s. Also, prices for green power might decrease due to the growth in production of the last few years. All of this leads BNEF to believe that “many projects with short-term PPAs are likely to prove unfinanceable and will therefore not be built.”

If this predicitons are true remains to be seen.

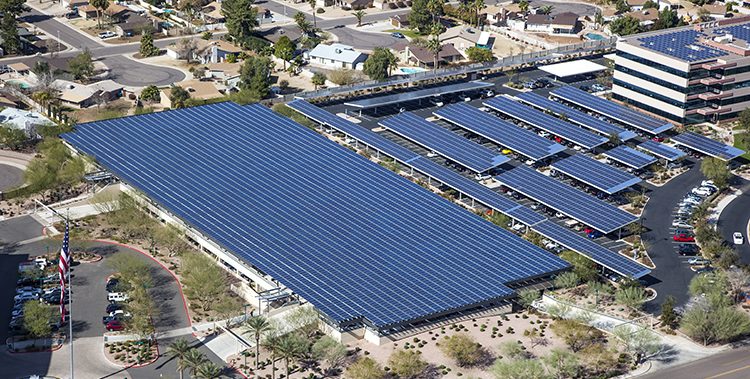

Title image: tim-roberts-photography/shutterstock