Tax Issues For Operators of Photovoltaic Systems

What tax issues do solar operators have to deal with? What do you have to pay attention to when you open a new PV-business? Gain an overview of your tax matters relating to your photovoltaic investment.

The tax aspect of your direct investment in photovoltaic systems involves several types of tax: income and profit tax, sales tax and trade tax – and it begins even before you open your power-producing business. Here you can get an initial overview of what you should pay attention to in different business-phases.

In order to get specific answers that correctly capture your individual situation, it is highly recommended to always consult a tax advisor.

Is it possible to save taxes before buying a photovoltaic system?

For income tax: Yes!

The most important option in practice is the formation of a so-called investment deduction amount (Investitionsabzugsbetrag – IAB): As a future solar operator with grid feed-in, you can form an investment deduction amount (IAB) according to Section 7 g Einkommensteuergesetz (German Income Tax – EStG) for the intended purchase or manufacture of your photovoltaic system.

Certain conditions must be met for this. The acquisition/manufacture must be planned within the next three years. The amount of the IAB may amount to up to 40 percent of the acquisition or production costs.

Example: In year 01 you plan to purchase a photovoltaic system in year 04 for € 500,000. This means that you can already create an IAB of a maximum of € 200,000 in year 01. However, you can also distribute the IAB over the years 01 to 03, e.g. create an IAB of € 100,000 in year 01,

€ 40,000 in year 02 and € 60,000 in year 03.

An IAB of 200,000 € is not enough for you? Then simply set up a second business, e.g. in the legal form of a non-trading partnership ( Gesellschaft bürgerlichen Rechts – GbR). In fact, is possible to form an IAB per company. The tax savings are particularly high if this income is subject to the so-called fifth rule of Section 34 EStG, as is the case in particular with a severance payment.

It should be noted that the IAB can only be formed in the years prior to the acquisition/manufacture of the photovoltaic system, whereby the transfer of benefits and burdens in the case of a purchase depends on you. Therefore, this often takes place on January 2 of the year following the formation of the IAB.

If, however, you do not make any purchases/manufacture within three years of the initial formation of the IAB, the IAB will be dissolved with retroactive effect at an interest rate of six percent per year. This interest rate is currently legally disputed. You also have the option of claiming further operating expenses, such as consultancy costs.

In order to make the intended acquisition/manufacture of a photovoltaic system credible to the tax authorities, it is advisable to register a business “operation of a photovoltaic system” (see below) and to obtain offers for the acquisition of such a system.

For trade tax: No!

In the case of trade tax, operating expenses can only be claimed from the start of the advertising business activity, i.e. when all requirements for the provision of the company’s services have been met. As a result, the PV-system must belong to you and the feed-in must be started.

For sales tax: Yes!

You only generate sales from the start of feeding electricity into the grid. However, you can have the VAT amounts invoiced for the planned operation refunded by the tax office as so-called input tax. This applies from the first preparatory action, which must be proven by objective features, e.g. the conclusion of a consultancy contract for the purchase of a photovoltaic system, trips to visit systems, etc.

How to open the business

The following points must be completed for the opening of operations:

- In the case of companies: Conclude the shareholder agreement in writing, even if notarization is not required. The same is true for the contracts of managing directors (both for tax and liability reasons).

- Registering a business: with the municipality or city.

- Register your business with the tax office: Register your trade with the appropriate questionnaire for tax registration. When registering your business, remember to also apply for a VAT identification number. Alternatively, you can apply for it afterwards at the Federal Finance Office.

- Opening balance sheet: may have to be prepared.

- Permanent extension of the payment deadline: if necessary, apply to the tax office for a VAT extension.

When opening a business, there are different questionnaires for sole proprietorships, partnerships or corporations. In case of doubt, you should always consult a tax advisor in order to reach your goal as quickly and easily as possible.

Clarifying the method of determining the taxable income

The method of determining the taxable income needs to be defined at the moment when the business is opened. The following methods are possible:

Double-entry bookkeeping with balance sheet:

(= comparison of business assets, Sections 4 para. 1, 5 EStG). The advantages of double-entry bookkeeping are: overview of the company’s assets, especially receivables and liabilities. Certainty that the result does not depend on coincidences such as the time of payment.

Disadvantages are the relatively high effort and relatively high costs. Simplified, the following scheme applies to the comparison of business assets:

Business assets at the end of the current fiscal year

– Operating assets at the end of the previous fiscal year

= Difference amount

+ withdrawals

– Deposits

= result of the financial year

– unreal operating expenses

+ non-deductible operating expenses

– tax-free operating income

= profit (or: loss)

Cash-based accounting (Section 4, para. 3 EStG):

The advantages of this method lie in its simple implementation and low costs. The disadvantage is that you do not get an overview of the company’s assets and the result is partly dependent on coincidences. Simplified, the following scheme results for the cash-based accounting:

Operating income of the current financial year

– Operating expenditure of the current financial year

= surplus revenue or expenditure

– Depreciation on depreciable

Fixed assets

-book value of sold or withdrawn

Fixed assets (and certain goods of current assets)

= profit or loss

Cash flows resulting from deposits and withdrawals are not to be considered in the cash flow statement.

Only partnerships, such as oHG, KG and GmbH, are required to prepare a balance sheet. You as the operator of a solar plant will probably have an annual turnover of less than € 600,000 and an annual profit of no more than € 60,000. According to Section 141 para. 1 Abgabenordnung (AO) you can and should choose the revenue-surplus calculation for simplification.

Depreciation

After purchasing/manufacturing the photovoltaic system, you can claim a special depreciation of 20 percent of the remaining amount according to the IAB.

Example: Investment 500 T € ./. 200 T € IAB = 300 T €. Of this 20 % is 60 T €. For this special depreciation there is an option to claim it in the year of acquisition and the four following years. The remaining book value 500 T € ./. 200 T € ./. 60 T € = 240 T € is depreciated (simplified) on a straight-line basis over 20 years.

Major tax types

Value added tax (VAT)

Companies can offset the VAT they pay on purchases (= input tax) against the VAT they collect on sales (here electricity sales). If the sales tax collected is higher than the input tax paid, a so-called sales tax payable arises – the company must pay the difference to the tax office. In the investment phase it is often the other way round, in which case the company is reimbursed by the tax office for the input tax amount in excess of the VAT collected.

However, smaller photovoltaic systems can fall under the so-called small business regulation of Section 19 Umsatzsteuergesetz (UStG). VAT is not levied by law (unless the VAT is shown on invoices) if:

- the total turnover + VAT of the company in the past year was up to € 22,000 and

- in the current year are expected to be below € 50,000.

This is based on all the company’s sales. If the operator of the solar system additionally generates other sales subject to VAT (e.g. from a sole proprietorship), the sales of both companies are added together.

Those who fall under the small business regulation cannot deduct input tax. This applies in particular to VAT on the acquisition/manufacturing costs of a photovoltaic system and is therefore initially disadvantageous for the operator.

For this reason, the operator should, if necessary, waive application of the small business regulation at least initially and opt for VAT liability. The corresponding application can be made until the VAT assessment notice is incontestable. The operator is then bound by this waiver for five years and is thus liable to pay VAT.

Payment of turnover tax: There are two ways in which the sales tax payable arises. Either the agreed or collected fees are taken as a basis:

Target tax (normal case):

- Calculation according to agreed charges

- Payment of the tax already after service provision, i.e. before receipt of payment = liquidity disadvantage!

Actual taxation:

- Calculation according to fees received

- payment of tax only after receipt of payment

Actual taxation is permitted under Section 20 UStG if there is no obligation for aa mandatory accounting or if the total turnover was less than € 600,000 in the previous year. This is usually the case for operators of solar systems, so you should choose target taxation for liquidity reasons.

This requires an application to the tax office. In both cases, the sales tax correctly shown in invoices to the operating company can be claimed as so-called input tax upon receipt of the invoice, i.e. if applicable even before it is paid.

Turnover tax deadlines: According to Section 18 UStG, turnover tax must be reported electronically by the tenth day after the end of the pre-registration period. A permanent extension of one month is possible. If the operator of the solar energy system hereby takes up a professional or commercial activity for the first time, the pre-registration period in the current and following calendar year is the calendar month.

Otherwise, the pre-registration period is always the calendar month. If the value added tax for the previous calendar year did not exceed € 7,500, the calendar quarter is the pre-registration period; for up to € 1,000, the obligation to submit pre-registrations is waived upon request.

The VAT return must generally be submitted by 31 May of the following year. In the case of tax representation, the deadline is 31 December of the following year.

Set up reserves for tax payments

Sufficient reserves should definitely be set up for the photovoltaic taxes due after the special depreciation expires. A regular review should be carried out on the basis of current accounting figures and your earnings and liquidity planning.

Otherwise, there is a risk of high tax refund payments and increased advance payments, usually retroactively for two years, for which no sufficient liquidity is available. A lack of tax reserves is a common mistake made by founders, which often leads to insolvency.

Trade tax

Amount of trade tax: The basis of assessment is the trade income of the company. For small companies, this is usually largely identical to the profit. However, if an IAB is used prior to the start of operations, it is not deductible from trade tax. The amount of trade tax depends on the multiplier applied by the relevant municipal authority.

Trade tax = trade income x 3.5% x multiplier applied by the relevant municipal authority

For sole proprietorships and partnerships there is an allowance of € 24.500. The trade tax is not tax-deductible as a business expense.

Trade tax deadlines: Advance payments of trade tax are due on 15.2., 15.5., 15.8. and 15.11. of each year. The trade tax return must be submitted by 31 May of the following year. In the case of tax representation by 31 December of the following year.

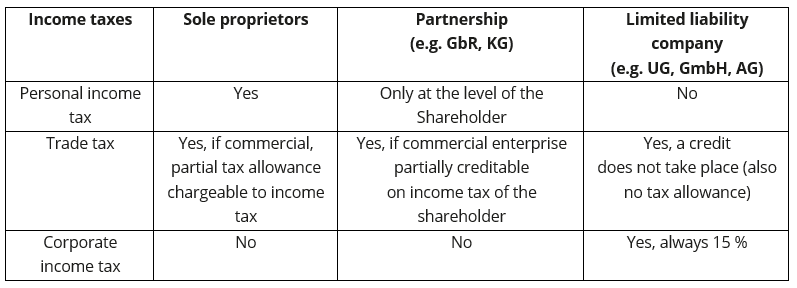

Income taxes

Solar operators are faced with the following question: in order to optimize your income and profit taxes, it is important to think about the right legal form of the company at an early stage. It is advisable to discuss this question with a tax consultant.

The following income taxes may apply:

As a rule, the operator of a solar system wants to make use of the possibilities of Section 7 g EStG, i.e. to form the IAB and use the special depreciation to reduce his own income tax. This is only possible if the solar system is purchased as a sole proprietor or within the framework of a partnership. In the latter case, each partner only has a pro rata share in its earnings, limited partners are additionally limited by the amount of their contributions.

If this is nevertheless the case, profits are subject to trade tax and a corporation tax of 15 %. Distributions to partners who are natural persons are taxed as follows:

- Shares held as private assets: usually withholding tax 25 % + solidarity tax, possibly partial income procedure (for cooperation or participation of 25 % or more) or normal assessment (for tax rates below 25 %)

- Units held as business assets: always partial income method, i.e. 60 % of the distribution is taxable, 40 % tax-free.

This article was created with the kind support of Alexander M. Hill, Dipl.-Kfm. Tax advisor and Partner, Ratzke Hill Partnerschaftsgesellschaft mbB and Klaus G. Finck, Attorney and Tax advisor, FASP Finck Sigl & Partner Rechtsanwälte Steuerberater mbH.