Direct Investment: Differences Between Project Phases

Investments in PV projects can be made at different project stages. Are new or existing photovoltaic systems more lucrative? Find out what opportunities and risks these asset variants entail.

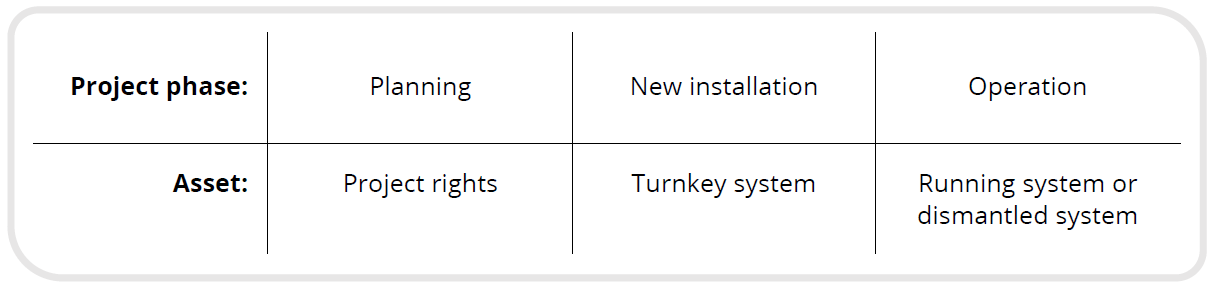

If you want to invest in a commercial photovoltaic system, you have to decide in which project phase you want to do so. For direct investments, you can choose between project rights, new turnkey systems, existing systems in operation or dismantled systems.

Find out just what lies behind these asset options, what advantages and disadvantages the variants have in practice, and how they affect returns.

You can invest in the following assets

The biggest difference between the asset variants is whether the PV system is newly built or already in operation.

Turnkey systems: “Turnkey” means ready to operate. The new systems are handed over in a condition in which they have been completely built and connected to the grid.

Project rights: You acquire the rights to construct and operate a PV system. These include, among others, the right to use the space (e.g. lease or purchase agreement), the right to feed the electricity into the grid (feed-in commitment from the grid operator) and the right to build and operate the system (building permit).

Existing systems: You purchase an existing PV system that has already been “connected to the grid” for a period of time and feeds electricity into it. It already has a production history.

Dismantled systems: These are existing systems that are disassembled and rebuilt at a new location. In the process, the respective EEG remuneration is carried over. The generator (or at least the modules) must be moved. Which other components are also moved depends on their age (inverters) and their reusability (substructure).

Payment dates for assets

Once a planned PV system is “ready to build”, project rights are usually already paid for in full and transferred. Ready to build means that all permits have been obtained and all contracts concluded. In special cases, staggered payments are agreed upon, which are then linked to the stage of development.

Despite what the term “turnkey” may suggest, purchase can also be made before the plant is handed over ready for use. Investors often finance the construction of the PV system step by step using partial payments.

This is comparable to real estate development projects, which are to be financed in fixed instalments according to the progress of construction. Particularly when payments are made according to construction progress, the payments should be well secured.

In the case of existing systems, the purchase price is paid at a point in time defined in the purchase agreement during ongoing operation. However, the payment can also be staggered, e.g. a down payment is made when the contract is signed and then a final payment after confirmation of change of operator by the grid operator and the transfer of the land registry easements.

For the transaction of a dismantled system, it must be precisely defined which party assumes which tasks. Tasks eligible at the time of purchase are: dismantling, packing, transport, reassembly or recommissioning.

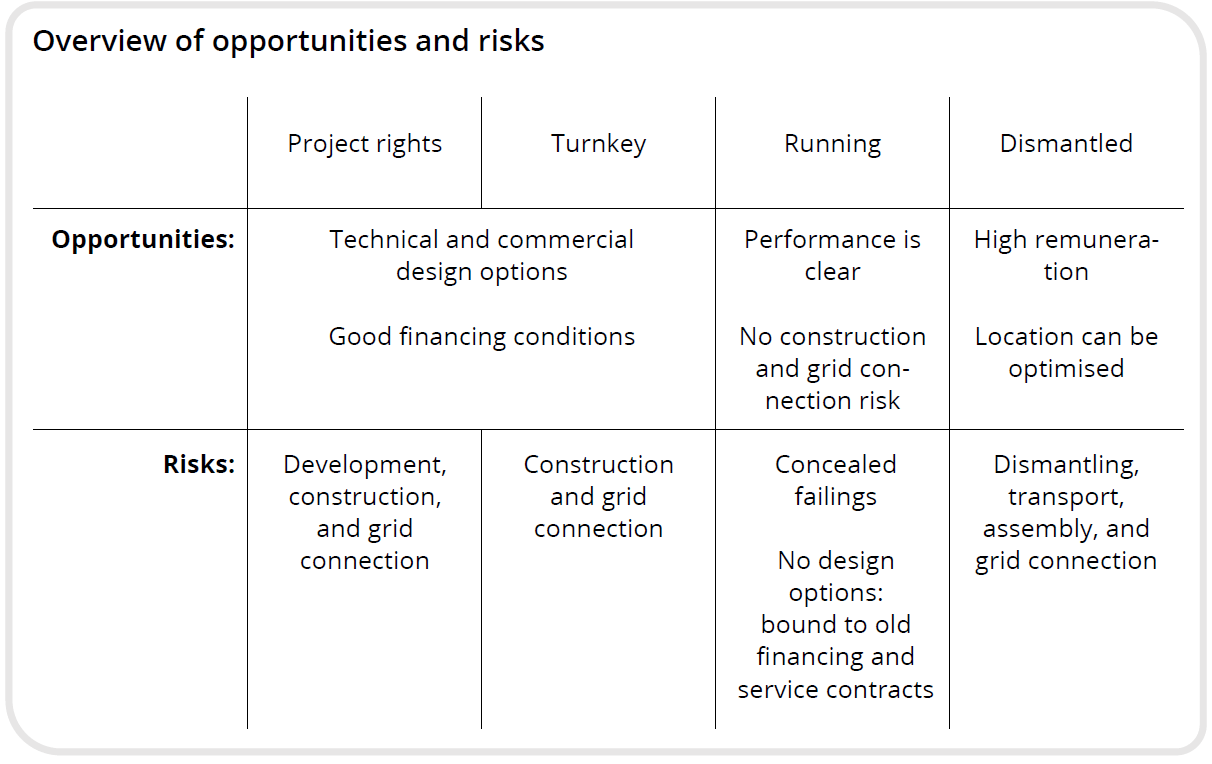

Opportunities and risks

Project rights: When purchasing, the investor can usually exert a great deal of influence on the construction of the PV system. On the other hand, depending on the development phase, they also usually bear the development risk in addition to the future construction and grid connection risk. It is, however, possible to participate in the total value creation of the project.

Turnkey systems: When investing in a turnkey system, the investors’ wishes in terms of the installed components (modules and inverters) or the contract design with the lessor, the financing bank, or future service providers can be taken into account if necessary.

The investor should have the future performance of a turnkey system demonstrated by an expert yield report. A professional construction inspection of the connected PV system provides the certainty that the forecasted yields can also be achieved in the future. A significant advantage of turnkey systems are the currently highly favourable financing conditions.

Existing systems: The project design is mostly completed, unless financing and service contracts do not have to be taken over at the time of purchase. Older financing is more expensive or can usually only be paid off with a prepayment penalty. On the other hand, unlike new systems, buyers of existing systems have no construction and grid connection risks.

The performance of existing systems can be easily determined on the basis of historical yield data. Yield-relevant, technical deficiencies can be identified with a technical inspection before purchase of the system. In the case of a takeover of the operating company (share deal), there may be audit risks arising from the past. If, for example, it turns out that back taxes are due, this is also “bought” with the takeover of the business.

Dismantled systems: It is always an excellent opportunity if you can acquire the old system with high remuneration at a good price and then operate it at an optimal location. Here, too, it is important to know the risks and assess them correctly. Problems can arise during dismantling, transport, reassembly, and reconnection to the grid. These risks can be managed professionally by having experienced partners provide legal and technical support during the process.

Expected returns

This only leaves the final question of returns: in this, existing and new systems should not differ. In all project phases, the returns are based on the value resulting from the reduced cash flows of the remaining remuneration years. This means that the respective acquisition costs are offset by the current remuneration on the electricity fed into the grid, the remaining term of the remuneration, and the ongoing costs of operating the PV system.

For project rights and turnkey systems, the returns depend on the total costs. In the case of project rights, these consist of the purchase price for the project rights and the actual construction and grid connection costs. Since you organise the construction yourself in the case of project rights, this can further optimise the return.

In turn, you bear the full construction risk. With turnkey systems, on the other hand, the construction risk is smaller and the total costs depend solely on the purchase price. For an existing system that has been connected to the grid for several years, the remuneration rate will be higher than for a newly built PV system, but its remaining lifetime will be shorter.

In all project phases, the pricing of opportunities and risks determines the purchase price and your return on the investment. This is why good preparation of price negotiations is important when buying a project.

This article was published in our investment guide. For all other articles and information on Direct investment in commercial-sized photovoltaic systems, please visit: Milk the Sun – PV Investment Guide.