Dormant Assets: The Underestimated Value of Running Commercial PV Systems

Owners of commercial PV systems often tend to underestimate the real value of their PV system. Digital marketplaces, such as Milk the Sun, support plant owners in assessing a fair market price and provide helpful services and knowledge in the event that a PV plant is to be sold. In addition, Milk the Sun regularly provides up-to-date information on all aspects of operating and investing in commercial PV systems, as well as current market analyses.

Ensuring a stable revenue base for running commercial PV-systems

Digital marketplaces provide a platform for the trade of commercial PV-systems, and act here as intermediary. This gives them detailed insights into the market value of PV projects, with regard to running systems as well as project rights, and turnkey or dismantling systems. Milk the Sun gathered and analyzed this specific knowledge in a recent market study. The result shows particularly at what high prices running systems are recently traded. Existing plants benefit from higher state EEG subsidies especially when they have been connected to the grid several years ago. This can be explained by the fact that the German subsidy mechanism was designed as such that these subsidies began at high which are consistently being lowered since then.

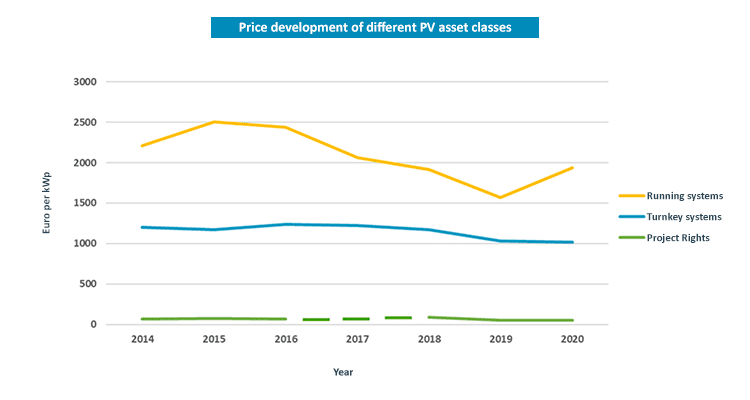

The chart at the beginning of the article shows the price development of different PV system classes. (in 2017, no sufficient data existed for the prices of project rights)

The data of the market price study indicate, as shown in the diagram, that (at the time of the study) running commercial PV plants from before 2012 reach an average price of around 1,500€/KWp. For newly constructed turnkey plants, on the other hand, prices tend to be below 850€/KWp. Looking at these numbers, it is important to notice that these differences in the prices cannot only be explained by financial mathematics but have also to be seen as an expression of a high demand with a low overall supply.

For older existing plants, the advantageous ratio of acquisition costs and feed-in tariff plays an important role. “Since current investors are satisfied with comparatively lower returns, there is an opportunity at the moment for owners who want to sell their PV plant to generate enormous additional profits in sales,” explains PV-expert and founder of Milk the Sun, Dirk Petschick. Technically well-running projects, with a good level of documentation, can sometimes be sold within a few weeks.

Older PV systems are more valuable than often thought – if they were maintained with care

Even if older PV plants achieve higher sales prices on average, a whole range of influencing factors play a role in the valuation of an individual plant. That is why the value of a plant cannot simply be deduced from its age or the EEG compensation rate. A detailed assessment of its technical condition, as part of a due diligence review, therefore, provides an appropriate reference point for a more realistic valuation.

In order to maintaining the value and thus to optimizing the return on the PV investment, a proper maintenance and care of the plant play a major role. Operators should be sufficiently concerned with the necessary tasks even if their core business is not in the field of renewable energies, as is the case for farmers or commercial operators who might use the solar energy to reduce the energy costs of their business. Milk the Suns’ Operator Guide provides a comprehensive overview for all those who wish to obtain more detailed information about the tasks involved in the operation of commercial PV systems.

Reasons for selling existing commercial PV systems

If the personal effort for proper maintaining a plant becomes too high, the sale of the PV plant can be a solution. Another reasons which might lead to a situation where selling is a good option can be the procurement of additional liquid funds, for example for new investments, or to avert an impending insolvency. Divorce or inheritance can also be reasons for selling a plant.

Conclusion

The value of existing PV plants is easily underestimated, especially if they are older plants with high EEG compensation rates. Moreover, since the demand for PV plants is basically high, the sale of these plants can often be financially beneficial.

Online marketplaces such as Milk the Sun offer sellers a free platform, where they benefit from many years of experience and a broad network of experienced PV investors. Through professional support, for example in the question of a suitable market value of the plant, as well as optimized processes in linking the transaction parties, digital marketplaces can play an important role in the mediation of commercial PV projects.

For more information on investing, see the Milk the Sun Investment Guide (2021).

The article was written in collaboration with Dr. Katja Reisswig. It was first published in a modified form in EW Magazin für die Energiewirtschaft.