Electricity price trends up to 2035: How much is my PV project really worth?

At the peak of the energy crisis in August 2022, wholesale electricity prices had risen fivefold compared to the previous year. At the same time, the market value of solar power also increased. The price increase began in the autumn of 2021 and seems to have come to an end: in June 2023, electricity prices fell back to the same levels as in the summer before the energy crisis.

The long-term development of electricity prices up to 2035 and beyond is decisive for the profitability and value of PV investments if we want to calculate electricity prices that should be able to be achieved beyond the fixed EEG remuneration. The development of electricity prices depends on many price factors, such as the price of LNG gas, the rate of expansion of renewable energies, the move away from coal, the degree of electrification of the heating and mobility sector as well as regulatory market conditions. Accordingly, the long-term price level could well increase or decrease.

With the energy crisis looming over us, it is often assumed electricity prices will remain high. For example, a professor quoted by German television news outlet “Tagesschau” considers a price level of 60–80 cents per kilowatt hour to be realistic in 2030 if gas prices rise again and the expansion of renewable energies stagnates. Once a high price signal is set, it is generally difficult to break away from it. That is to say, it is always thereafter considered to be “very much possible”.

Which electricity price forecast are you using?

We have compared different electricity price forecasts. The different electricity price forecasts simulate different scenarios.

And the range of prices can be quite wide: according to the “EU Energy Outlook 2060”, for example, the average baseload prices in 2035 differ by around 46€/MWh. If tensions between the EU and Russia persist, the average wholesale price in Europe will be around 107€/MWh according to the Outlook. If the situation eases again, the wholesale price in 2035 should be around 61€/MWh. In the moderate “central” scenario of the Energy Outlook, the wholesale electricity price in 2035 would be 73€ per megawatt hour. In 2021, the average spot market price was around 62€ per megawatt hour.

The “EU Energy Outlook 2060” by Energy Brainpool and the “vbw Electricity Price Forecast” by Prognos are based on the following assumptions:

| “Central” scenario of EU Energy Outlook 2060 (EU27, CH, NO & UK) | “vbw Electricity Price Forecast” (Strompreisprognose vbw) (Germany) |

|

| Renewable energies |

Significant, highly decentralized expansion: by 2050, 76% of electricity generation will come from renewable energy sources. 62% of these energy sources are wind and solar. |

The expansion path for renewable energies defined in the EEG 2022 (Easter package) will be achieved. By 2030, 74% of net electricity production will come from renewable energy sources. By 2040, photovoltaic capacities will account for ⅔ of the expansion. |

| Coal power stations | In Europe, the production of electricity using coal will fall by 73% by 2030. By 2050, it will have fallen by 92%. | Coal to be phase-out completed by 2030 |

| From gas to hydrogen |

LNG from the US will initially become the main source of price-setting imports. In the long run, green hydrogen will replace fossil natural gas. By 2040, green hydrogen will be cheaper than gas. By 2050, 7% of electricity will come from flexible gas-fired power plants powered by green hydrogen. |

Gas backup capacities will initially be operated with LNG and after 2028 hydrogen will increasingly be used. Unregulated, the price of hydrogen would drive up the price of electricity. |

| Nuclear power | 11% of electricity in Europe in 2050. | Germany’s nuclear phase-out remains complete. |

| Electrification in the mobility and heating sector | Europe’s electricity demand will increase by 71% by 2060. Until then, the heat sector will be completely decarbonized; 95% of mobility will be electric. | Germany’s electricity consumption is increasing significantly. By 2030, there will be 16 million battery-electric vehicles, 6.5 million heat pumps and a hydrogen production of 37 TWh. |

Based on these assumptions and studies, significantly lower wholesale prices for electricity can be assumed – but only as an annual average. Over the years, price fluctuations have increased. Although prices are decreasing, they are not expected to return to the levels seen before 2019/2020.

How is the market value of PV electricity developing?

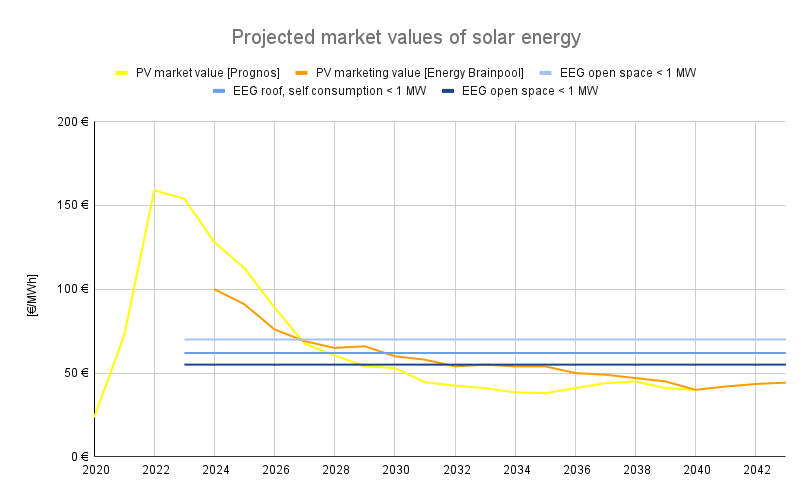

The future market values of solar power are decisive for the value of PV projects. Both forecasts offer insightful results which you can find in the following chart. You can also see possible EEG revenues for PV systems that will be connected to the grid in 2023.

Source: Own depiction, Prognos and Energy Brainpool

Both forecasts show that the market values for solar power are down significantly in the medium term. The European average shown in orange is unclear, as prices within the individual European markets can vary by between 40 and 60 euros.

Prior to the so called “Strompreisbremse” (electricity price brake), additional revenues from PV projects were possible in subsidized direct marketing whenever the PV market value was higher than the possible feed-in tariffs. This principle can now change permanently: in March 2023, the EU Commission presented its proposal for a reform of the design of the electricity market. The draft contains two-sided contracts for difference (CfDs). Should these be finally decided, in the future all amounts above the EEG tariff would be “skimmed off” the subsidized direct marketing while the difference to the feed-in tariff would be paid.

For long-term electricity supply contracts (PPAs), the EU proposal provides for national guarantee schemes. Incentives are also provided for investments into energy storage and demand-side response solutions. In the case of the latter, the use of electricity is adapted to the electricity supply at economically reasonable times.

New business models come into play when discussing how to achieve revenues that go beyond a feed-in tariff. With the help of hybrid systems consisting of PV and storage, system services are already able to be marketed today.

Development of returns on PV projects

In addition to the revenue opportunities described above, three other drivers impact PV yields: financing costs, investment costs and ongoing operating costs (CAPEX and OPEX).

The following assumptions seem plausible to us:

Interest rates, which have skyrocketed due to the interest rate reversal, continue to rise slightly. If the measures of the European Central Bank work as intended, the inflation rate will stabilize. As a result, interest rates would probably settle at a significantly higher level than in 2021 compared to the low-interest phase. The high financing costs not only make the borrowed capital of the investments more expensive, but also tie up more liquidity, as the capital input required by the banks also increases significantly.

The investment costs (CAPEX) for the construction of new PV systems are currently falling slightly. Due to the high demand for PV systems, a substantial decrease in prices seems rather unlikely.

In the case of ongoing operating costs (OPEX), it remains to be seen how these will develop. Technical innovations that reduce prices are contrasted with the significantly increasing costs of personnel and operating equipment.

With decreasing revenues, low cost reduction potentials and at the same time high financing costs, it can be assumed that returns on new PV projects will decrease. Simultaneously, the range of PV projects is likely to increase. Additional revenue opportunities through network-serving hybrid applications are becoming increasingly interesting as part of this.

Summary

The general feeling that electricity prices will remain at a high level seems unfounded in view of the forecasts presented – provided that the expansion of renewable energies is successful and we refrain from future price fluctuations due to international crises.

Renewable energies are a significant price-reducing factor that also stabilizes energy prices, as it offers strategic independence from import prices. This, along with climate protection, speak in favor of consistent expansion of renewable energies.

The long-term forecast of electricity prices has a pricing effect in the buying and selling of PV projects. Investors who assume high electricity prices may be willing to accept a higher purchase price than price sceptics.

Those who do not want to use the EEG as a basis for tariffs must form their own opinions about prices, regardless of the forecasts, in order to make decisions about the purchase or sale of PV projects.

Following the results of the studies and the EU plans for a market design, it seems logical to us that we work on the basis of conservative EEG revenues. The longer the trend of falling prices continues, the more lower PV project values will prevail.

You can find out how to determine the value of PV projects in detail in the following article.